overview

Agent Hub was a one-stop solution for agents to carry out their operations and also an internal tool for them and company executives to monitor self performance, goals, compensations et al.

Insurance agent hub is the altered version of an app I had designed for a very reputed insurance company across the United States.

With over 40,000+ agents in their producer community, the client wanted to improve its sales performance

management ecosystem and create a mobile solution fitting for a modern sales organization that would make it one step closer to the firm’s vision of digitizing their entire process.

e.g. Traditional insurance claims submission required manual efforts to transfer from paper to system and obsolete document transfer methods like fax and emails were error prone and time-consuming.

Worked with client to design, develop, and launch Client Agent Hub - the first native mobile application in its history.

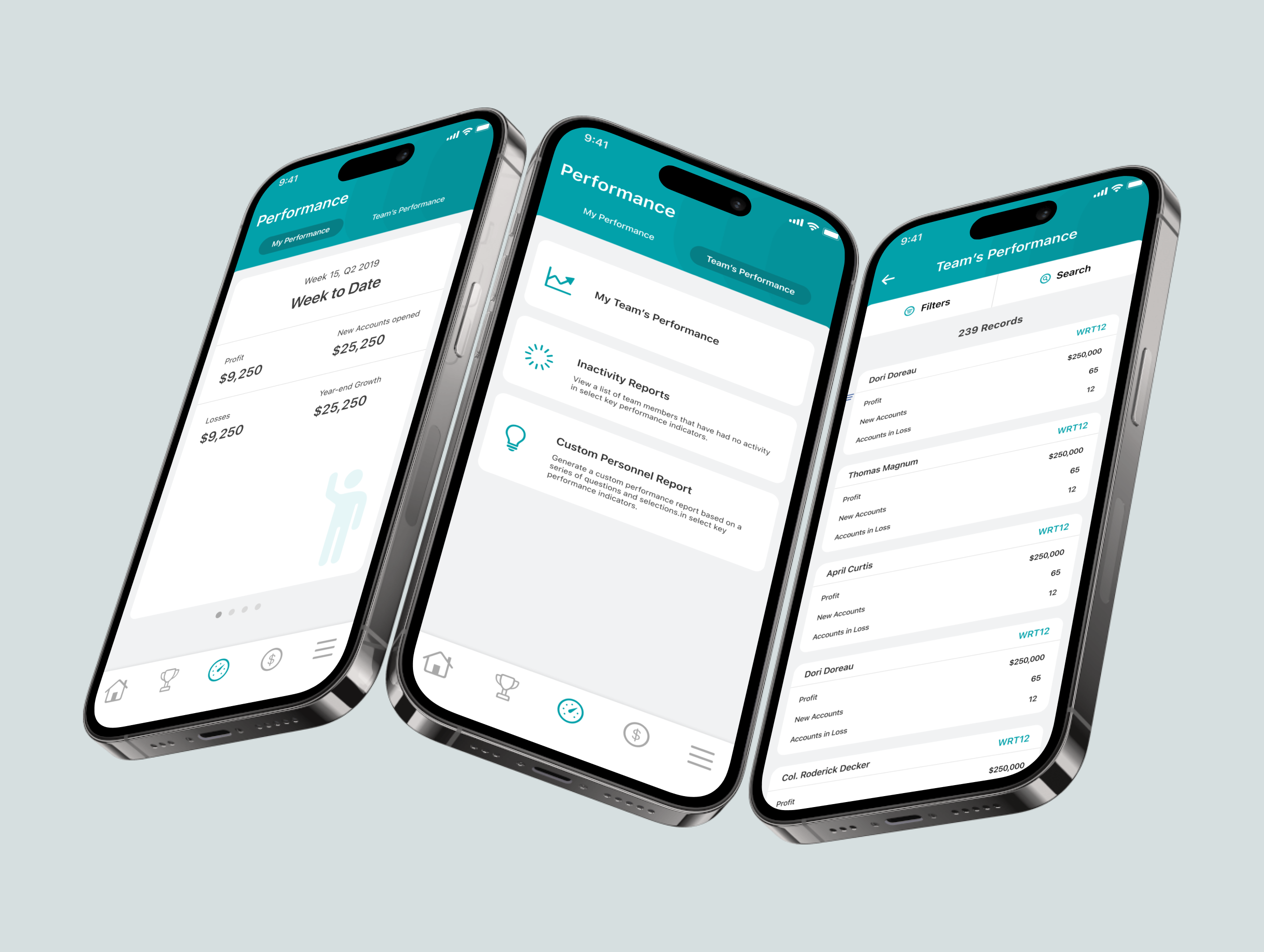

We created a one-stop shop for sales management that delivers a multitude of capabilities built around:

- Performance insights

- Gamification components

- Compensation statements

- An additional claims filing feature eliminated tedious document submission methods like fax, direct handover and emails. We used Xamarin that optimizes investments for both iOS and Android platforms. Keeping future enhancements and capabilities in mind, microservices and cloud computing were employed to ensure scalability and reusability.

The culmination of well-informed design, support services and cloud provided a strong infrastructure to power Agent Hub as a multi-faceted app.

learnings

As a Design Lead in my consulting firm on the Insurance Agent Hub project, I learned several valuable lessons:

- Risk Communication: Learning to communicate complex risk-related information clearly and intuitively.

- Regulatory Adherence: Designing solutions that adhere to strict insurance industry regulations and compliance standards.

- Claims Simplification: Simplifying the claims submission and management process for a better user experience.

- Gamification: Gained experience in the process of gamifying an otherwise stern and rigid plexus of processes.

- Customer Journey Optimization: Optimizing the entire customer journey, from policy purchase to claims resolution.

- Effective Data Visualization: Skill in visualizing data like performance KPIs and sales trends to aid decision-making for executives.

- Accessibility Focus: Ensuring accessibility compliance to cater to all users, including those with disabilities.

- Mobile Claim Capture: Designing mobile interfaces for capturing and submitting claim documentation.

team structure

My team consisted of one consultant designer and two analyst designers. I collaborated closely with the functional and development leads to ensure efficient delivery of work, while also managing client-facing operations.

Throughout the design delivery process, I collaborated closely with functional and development leads. We held regular brainstorming sessions to discuss design feasibility and technical considerations, ensuring that the final design solutions met both user needs and technical requirements.

Additionally, I facilitated design review meetings with key stakeholders to gather feedback and iterate on designs accordingly. I provided design specifications and assets to the development team, working closely with them to address any implementation challenges and ensure accurate translation of design concepts into the final product.

requirement(s)

The product was a digital platform which would encompass a myriad of functions across different user groups (namely Insurance Agents, Managers and Senior Managers)

For easier comprehension, the different workstreams can be categorized into 3 main buckets:

- Rewards: Self-compensation breakdown (Applicable to all users)

- Claim submissions (Applicable exclusively to field agents)

- Self performance/Team performance monitoring through KPIs (Former for all users, latter for managers and above)

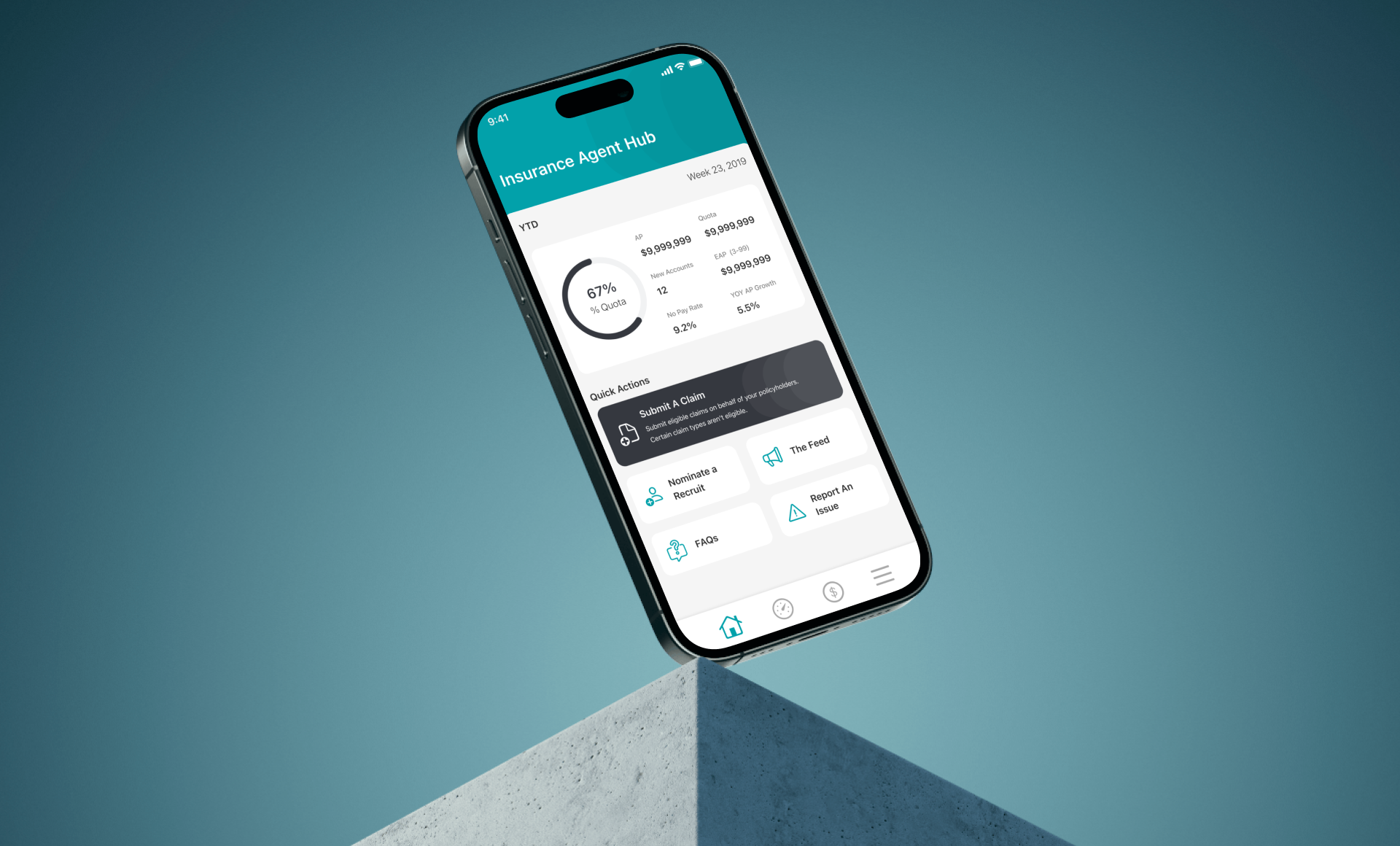

app landing page

Since there were a multitude of features packed into this "Super-App" designing the home screen was a very crucial task. The design revolved around making the landing page an access hub for all the features and sub-features and act as a landing dashboard with key metrics at the same time.

There is dynamic text showing sample tasks (like Get help with cooking/design/finances/programming etc.). A clear direct CTA (The textfield) to enter a query, Indicators of experts online to assure the user of people active on the platform and a help chat pre-populated for any queries/faqs (which would be answered by the operations team)

Keywords: No Clutter, Minimal, Direct

my rewards

Rewards was a sub-feature that let users assess their incomes based on different time frames and different levels of sales.

The client had company-specific brackets and breakdowns which were represented on the screens through infographics and tables to tally the same information.

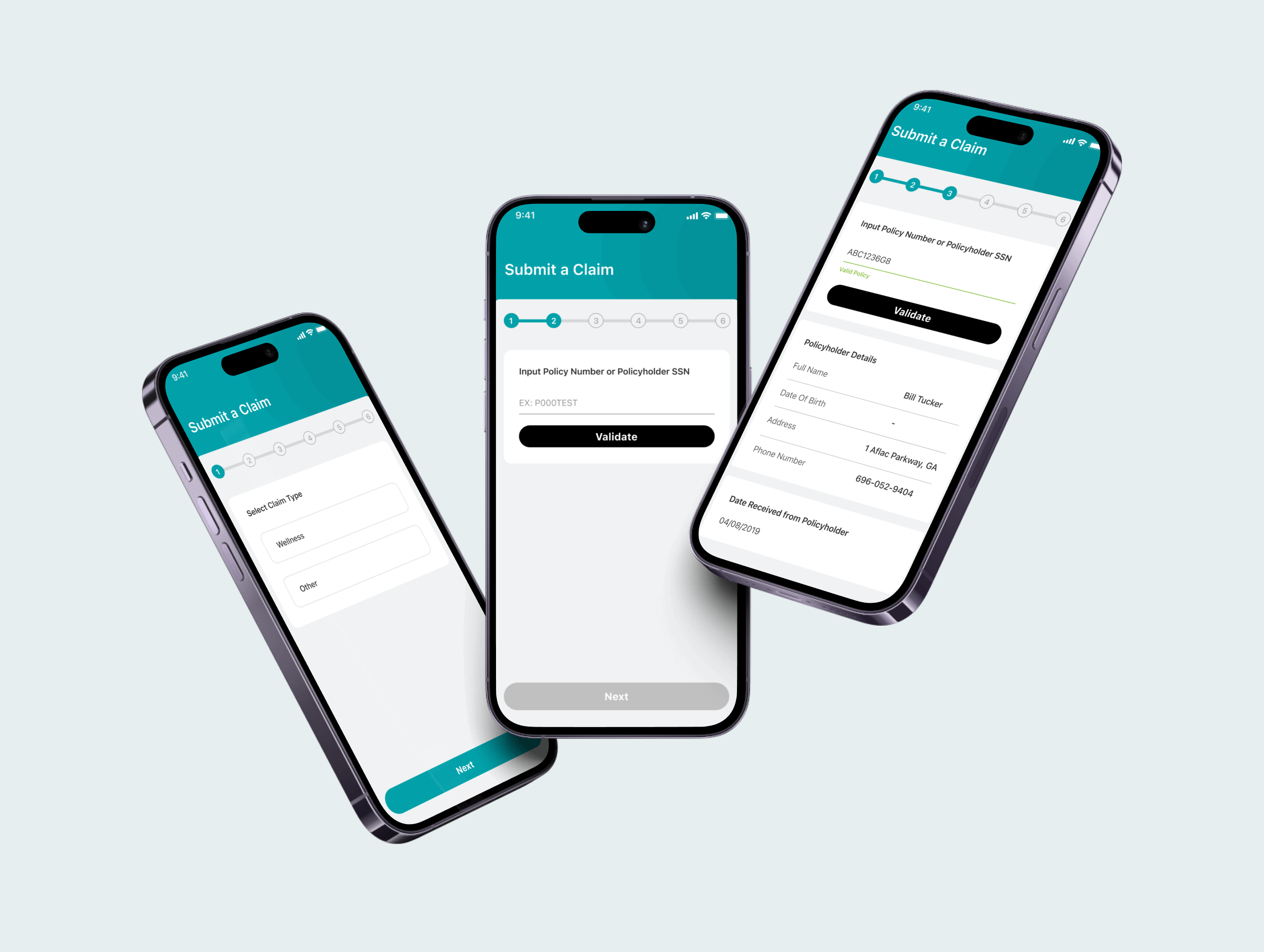

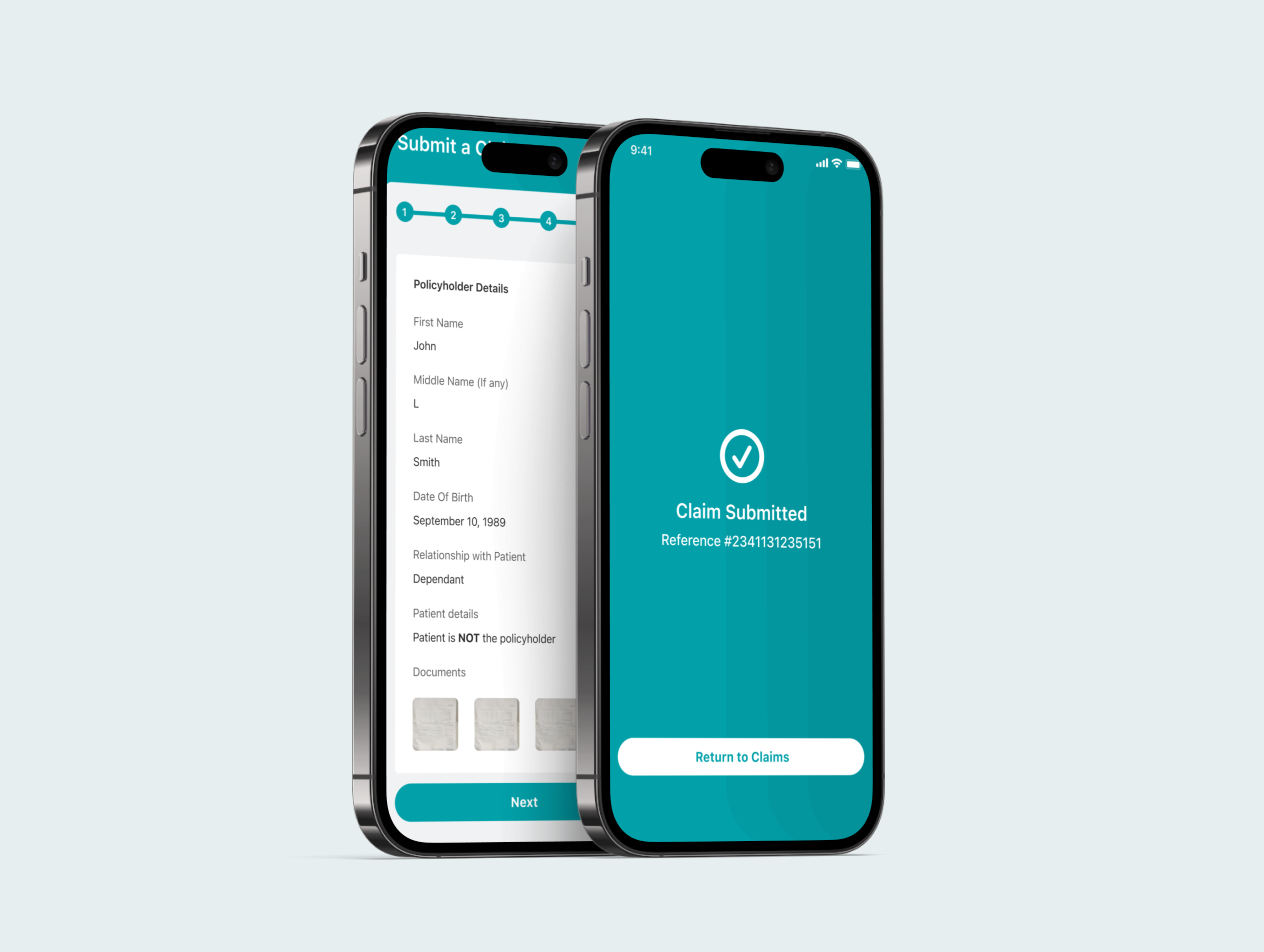

filing a claim

Filing a claim was a tedious process that involved a looooot of paperwork.

To digitize the process, we interviewed field agents to understand their schedules/company policies/protocols etc. and devised a 5-step process to digitize the entire process of filing a claim for a policyholder. Since there were some legacy restrictions, a complete digitization would've taken a few years to come to full effect.

performance KPIs

The performance sub-feature navigates the user to a sub-landing page where they can switch between checking their personal performance (default selection) over different time periods or their team's performance (limited to management and above). The information was displayed through different company specific KPIs which the users could filter and view through.

Want to know more?

Get in touch →

Bengaluru, India

Phone: +91 836 0183 960

Email: [email protected]

Created on Semplice © Atish Ray 2024